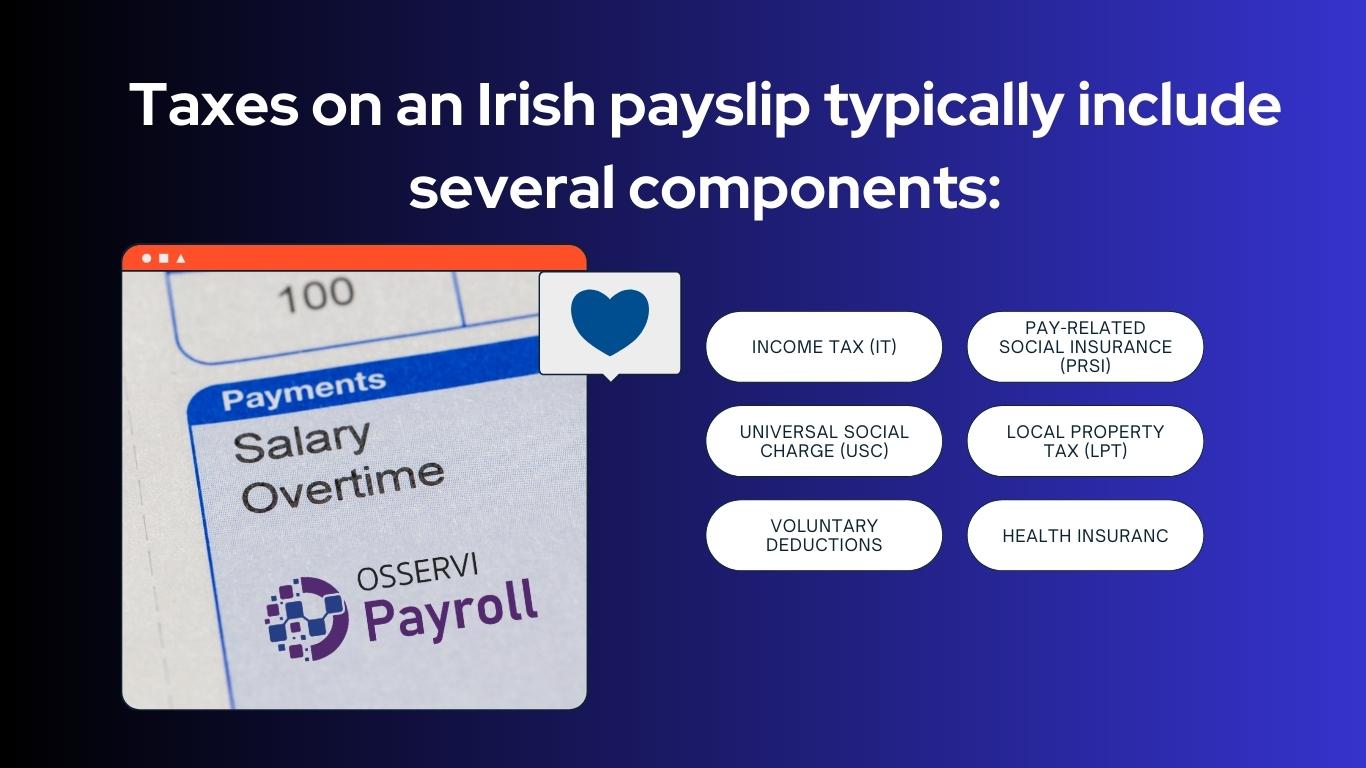

Income Tax (IT):

Income tax is calculated based on your total taxable income, which includes your salary or wages, as well as other taxable benefits. Ireland operates a progressive tax system, which means that different income bands are subject to different tax rates. The rates and bands may vary from year to year, so it’s important to refer to the latest tax information from the Irish Revenue Commissioners (revenue.ie).

Pay-Related Social Insurance (PRSI):

PRSI is a social insurance contribution that funds various social welfare benefits in Ireland. It is deducted from your gross income, including salary, bonuses, and certain benefits. The PRSI rates are also progressive and depend on your earnings. Different classes of PRSI apply to employees, self-employed individuals, and other categories of workers.

Universal Social Charge (USC):

The USC is another tax on your income, and it replaced the Health and Income Levies in 2011. It is calculated based on your total income, and like income tax, it operates on a progressive system with different rates and bands. The USC rates can change, so it’s essential to refer to the latest rates on revenue.ie.

Local Property Tax (LPT)

The Local Property Tax is an annual tax imposed on residential properties in Ireland. It is calculated based on the market value of the property and the relevant tax rate. The LPT is not deducted directly from your payslip but is usually paid separately by property owners. However, if you are an employee and have elected to pay your LPT through your employer’s payroll, it may be reflected on your payslip.

Other Deductions:

Your payslip may also show additional deductions, such as pension contributions or voluntary deductions for healthcare or other benefits. These deductions are specific to your employment agreement or personal choices.

It’s worth noting that tax credits and reliefs can reduce the overall amount of tax you owe. These are deducted from your tax liability, which lowers the amount of tax deducted from your payslip. Examples of tax credits include the Personal Tax Credit, the Employee Tax Credit, and the Home Carer’s Tax Credit. Various tax reliefs are available for specific circumstances, such as medical expenses or education expenses.

Remember that specific details may vary depending on your individual circumstances and any changes to tax legislation. It’s always advisable to consult the latest information from the Irish Revenue Commissioners or seek professional advice for accurate and up-to-date tax guidance.

Continue Reading

Get a personal consultation.

Call us today at (01) 5170179

Packages to suit your budget (we are on avg 30% better value than competitors)..

Frequent Searches Leading To Pages:

Payroll Services Ireland | Payroll Services | Payroll Ireland | Payroll Outsourcing Ireland | Outsourced Irish Payroll | Outsource Payroll Services Ireland | Outsourced Irish Payroll Services Dublin & Ireland | Ireland Payroll Service | Payroll companies Ireland | Payroll service provider